Rates from as low as

2.09% p.a.

Fixed Interest Rate1

2.59% p.a.

Variable Interest Rate2

3.77% p.a.

Comparison Rate1

2.62% p.a.

Comparison Rate2

2.09% p.a.

Fixed Interest Rate1

3.77% p.a.

Comparison Rate1

2.59% p.a.

Variable Interest Rate2

2.62% p.a.

Comparison Rate2

We’ll find you a better home loan

to pay off your mortgage sooner…

Why Refinance

There are many more things to consider when comparing loans and we understand it can be confusing and a big decision to make.

Our finance specialists have knowledge across many loans and products, and are here to help support you in making a confident decision.

Why Choose

Loftus Finance

At Loftus Finance, we understand the most fundamental step in implementing a successful financial plan is being able to borrow, maintain and manage loans in the most effective way.

At Loftus Finance we help our clients understand their options when it comes to choosing and structuring their loans. We are independent when it comes to our brokerage services, which means we help you get the best structured deal. On our clients’ behalf we approach and negotiate various financial institutions, and achieve the best possible result.

Our Partners –

compare and choose from over 30+ lenders

Our Lending Services

Talk to our finance specialists today about refinancing your home or investment loan

REFINANCING

on your mortgage with a

better rate and pay off your loan sooner.

DEBT CONSOLIDATION

of your debts with one repayment

at a lower interest rate.

SMSF BORROWING

as leverage to purchase

an investment property.

HOME LOANS

We offer a range of home loan options

to suited to your situation.

INVESTMENT LOANS

with competitive investor

home loan rates.

BUSINESS LOANS

to suit your business needs.

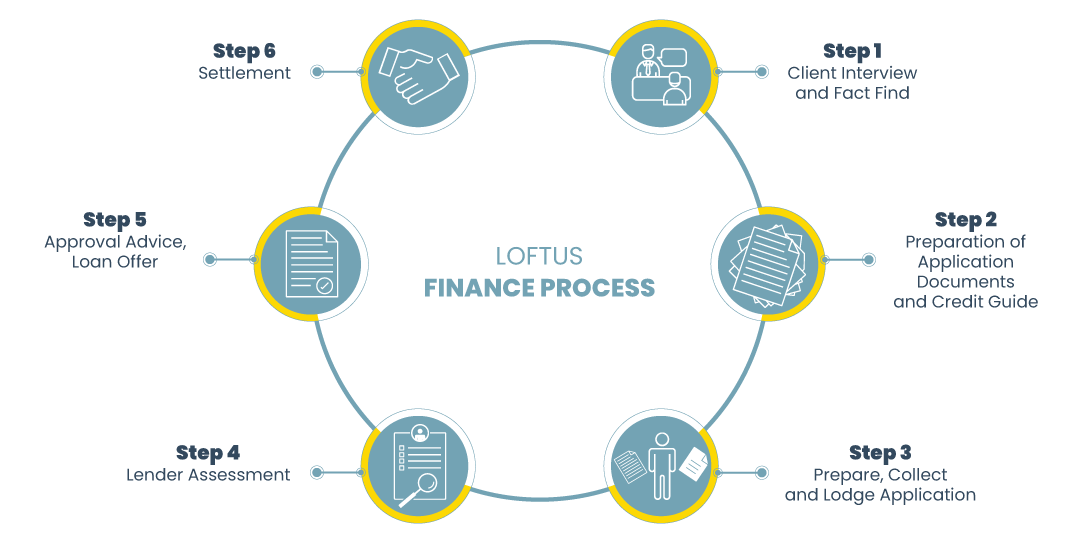

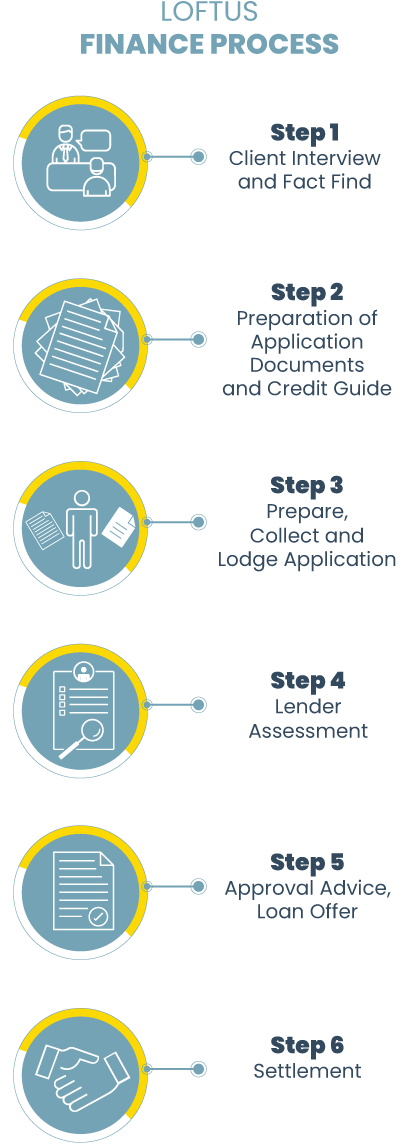

Our Process

Home Loan Calculators

Tools to help you budget and plan ahead.

Calculate your loan repayments and estimate how much you can borrow.

Let’s get started and

tell us what you need…

We’re here to help… ask us how

Talk to our finance specialists today about refinancing your home or investment loan